Balance Sheet

The balance sheet is one of the core financial statements used by accountants. A financial statement that summarises a company’s assets, liabilities, and shareholder’s equity at a given point in time. It gives owners an idea as to what the company owns and owes.

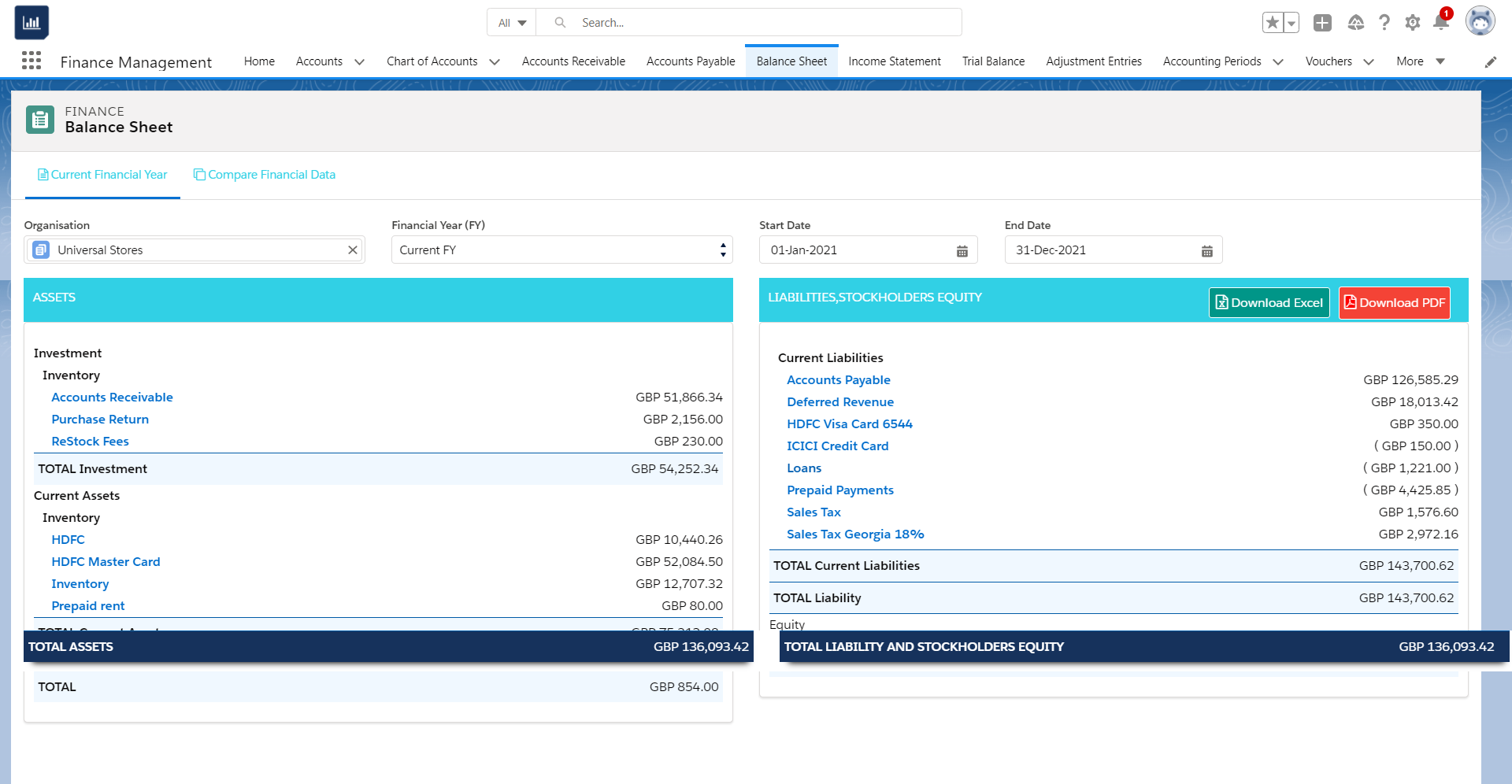

To access the Balance sheet, navigate to the Financial Management module and click the Balance sheet tab.

The report generated is based on the current fiscal year. This will display amounts till the presently posted transaction.

You can use the filters and calendar tool to drill down the balance sheet and know the company’s financial position at any point in time or as opposed to a given period. The balance sheet is divided into two columns, one is for assets and the other is for liabilities and stockholders’ equity. Fundamentally, the balance sheet must balance the total amount of assets with the total amount of liabilities and stockholders’ equity.

The balance sheet is auto-calculated using the latest data from the company’s accounts, which means the balance sheet is created in real-time. With Aqxolt ERP’s balance sheet, you don’t have to be a professional to do manual calculations. Whenever a transaction record is created, all the calculations and finance general entries are created automatically, eliminating errors in the balance sheet.

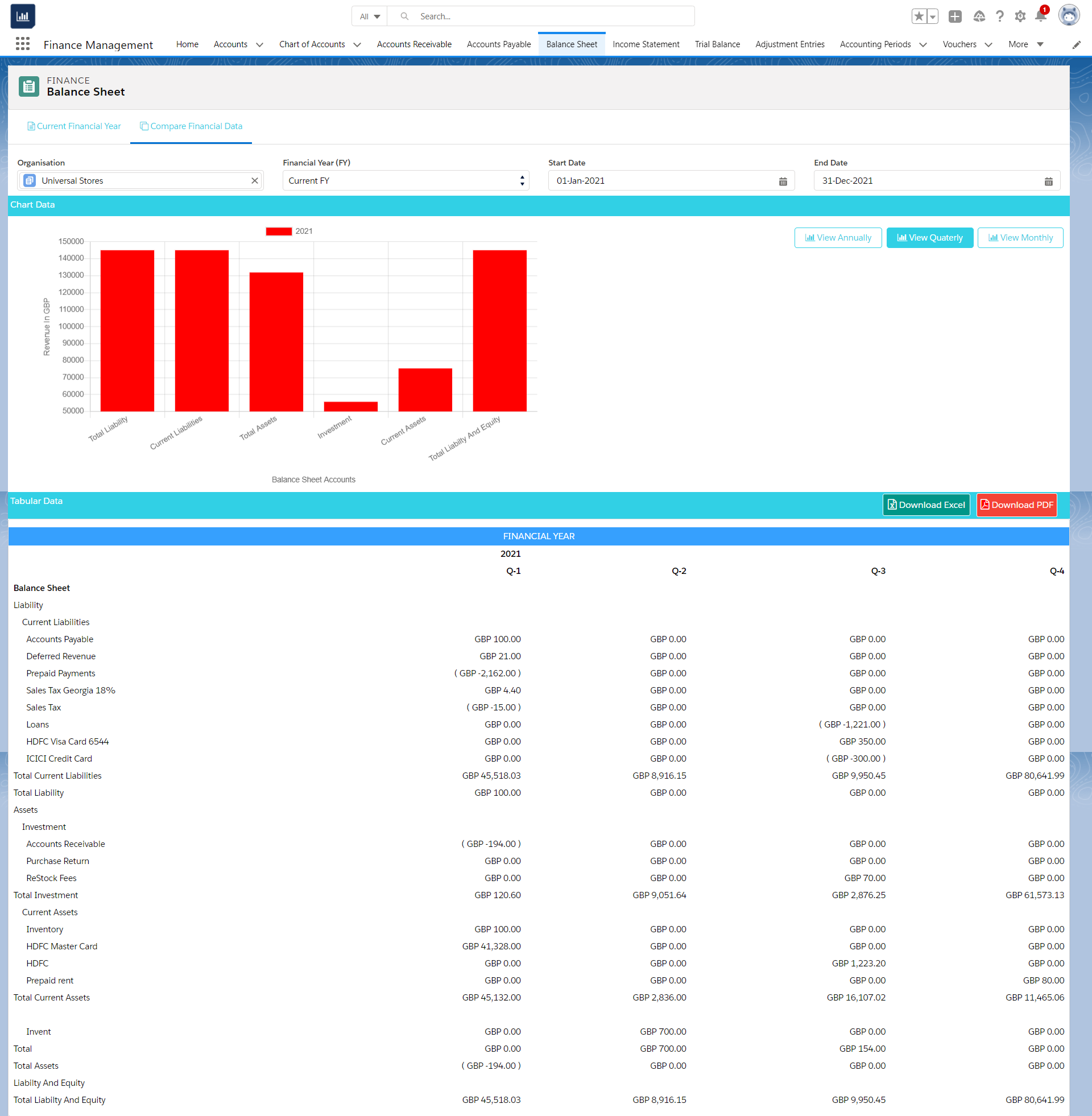

View the data that matters to you by using the filters provided to you. You can import the balance sheet for the selected organization and duration in PDF/Excel format by clicking the “Download PDF / Download Excel” buttons. To make good decisions by comparing financial data, click “Compare Financial Data”. Compare the data of your interest by using filter criteria and viewing the chart data annually, quarterly and monthly. View and download the tabular data by clicking “Download PDF/ Download Excel” for the financial year.

Let’s drill down the balance sheet closely. Depending on the nature of the business, the asset side of the balance sheet may contain many items, some of the examples includes Cash, Inventory, Accounts, receivable, Checking etc.,

The basic equation of the balance sheet states that the liability and the owner’s equity of a business are equal to the total sum of its assets.

Assets = Liabilities + Owner Equity

The other side of the balance sheet displays liabilities and stockholders’ equity. Liabilities are obligations and debt payable to the other entity. Some of the examples of liabilities include Sales tax, Accounts payable, Sales tax payable, Goods received not invoiced, etc.,

Equity is the value of a company’s capital. The basic equation of assets can be used to calculate the owners’ equity

Owners’ Equity = Liabilities – Assets

If the equation returns a negative value then it is dangerous to the growth of your business and difficult to secure the finance of the company. Some of the examples of equity include Retained earnings, Owners’ equity, Remuneration, etc.,

Let’s illustrate an example to understand the balance sheet. One of the customers in Universal stores purchases a Phone and its selling price is $1200 and the cost price is $900. The system generates a sales order for the customer with the invoice amount of $1200. The profit made by the Universal store is calculated using the following equation.

Profit = Selling Price – Cost Price

Therefore, the profit made by Universal Store is $300.

The sales order summary is illustrated in the table below

| Sales order | SO-xxxx | Customer: Serah |

| Qty | Unit Price | Total Price |

| 1 | 1200 | 1200 |

| Tax (20%) | 240 | |

| Sub Total | 1440 | |

| Discount (10%) | 144 | |

| Total Amount | 1296 |

The payments on the balance sheet are recorded only when the invoice is posted.

| When we make a sale, and Post the Invoice | ||

| Chart of Account | Credit | Debit |

| Sales | 1200 | |

| Accounts Receivable | 1296 | |

| Sales Tax Payable | 240 | |

| Sales Discount | 144 | |

| 1440 | 1440 | |

| Balance After Sale | |

| Sales | 1200 |

| Accounts Receivable(Mckinsey) | 1296 |

| Sales Tax Payable | 240 |

| Sales Discount | 144 |

Customer Serah makes the payment against the Invoice

| Serah Pays to Invoice | Amount |

| Invoice Amount | 1296 |

| Cash Payment | 1296 |

| Sales Order Status | Paid |

| Sales Order Stage | Shipped |

| When a customer makes payment (Cash) to Invoice | ||

| Chart of Account | Credit | Debit |

| Accounts Receivable (Serah) | 1296 | |

| Cash | 1296 | |

| Balance After Customer Payment Against Invoice | |

| Sales | 1200 |

| Accounts Receivable (Serah) | 0 |

| Sales Tax Payable | 240 |

| Sales Discount | 144 |

| Cash | 1296 |

Let’s illustrate an example to understand the balance sheet when sales return happens. Serah the customer of Universal Stores would like to return one of the items from the sales order purchased by her. The system generates a Return Merchandise Authorisation for the customer and the net sales are calculated by the following formula.

Net Sales Formulae = Sales – (Sales Return + Sales Discount)

| When a sale Return | ||

| Chart of Account | Credit | Debit |

| Sales Return | 1200 | |

| Sales Discount | 144 | |

| Cash | 1296 | |

| Sales Tax Payable | 240 | |

| 1440 | 1440 | |

| Balance After Sales Return | |

| Sales | 1200 |

| Accounts Receivable (Serah) | 0 |

| Sales Tax Payable | 0 |

| Sales Discount | 0 |

| Cash | 0 |

| Sales Return | 1200 |

Similarly, let’s illustrate an example understand the balance sheet when Universal stores purchase an item. Aqxolt ERP helps in the accounting of vendor invoices that the vendor bills towards the order. When the user raises the Purchase order to purchase item A and item B, the system creates a voucher against the purchase order. Every time a voucher is posted a general ledger entry is created in the system reflecting the credit and debit balance of the chart of accounts created for purchases.

| Inventory | ||||||

| Product Name | Serial No | Cost Price | Selling Price | Profit(SP-CP) | Available Stock | Stock Inward |

| Item A | 2345-5436-2356 | 78000 | 90000 | 12000 | 2 | 2 |

| Item B | 2345-5436-2378 | 88000 | 100000 | 12000 | 2 | 2 |

| After Voucher is Posted the Following Ledger Entries Will be Created | ||

| COA | Credit | Debit |

| Purchase | 332000 | |

| Accounts Payable | 332000 | |

| Inventory Accounting | |

| COA | Balance |

| Inventory | 332000 |

| Accounts payable | 332000 |

| Accounts Receivable | 0 |

| Sales | 0 |

| Purchase | 0 |

| Sales Return | 0 |

| Sales Tax | 0 |

| After Stock In Ward (Item A (2345-5436-2356)) is Posted The Following Ledger Entries Will be Created | ||

| COA | Credit | Debit |

| Inventory | 156000 | |

| Purchase | 156000 | |

| After Stock In Ward (Item B (2345-5436-2378)) is Posted The Following Ledger Entries Will be Created | ||

| COA | Credit | Debit |

| Inventory | 176000 | |

| Purchase | 176000 | |

When a Universal store returns an item purchased the system creates a transaction entry for the return purchase order and the following chart of accounts are affected.

| The Following Ledger Entries Will be Created If Not paid | ||

| COA | Credit | Debit |

| Accounts payable | 0 | 88000 |

| Inventory | 88000 | 0 |

| The Following Ledger Entries Will be Created If Paid with Cash | ||

| COA | Credit | Debit |

| Cash | 88000 | |

| PurchaseReturn | 88000 | |