Manage Taxes

A tax is a mandatory financial charge or levy imposed by a government on individuals, businesses, or entities to fund public services, infrastructure, and government operations. It is typically collected based on income, sales, property, or other economic activities, and failure to pay can result in penalties.

Simple Example:

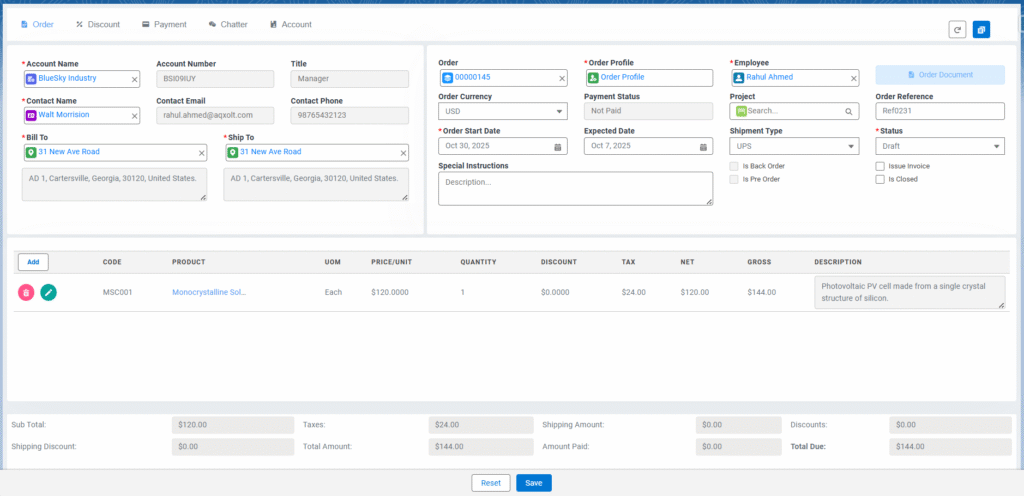

You’re selling a Monocrystalline Solar Cells for $120 (before tax) to a customer in a region with a 20% sales tax rate. The customer pays:

Subtotal: $120

Sales Tax: $24 (20% of $120)

Total Amount: $144

Axolt ERP enables tax calculation and eliminates manual processes that are subject to human error.

Taxes in Axolt ERP can be applied in the following ways:

- Assign taxes on Sales Orders

- Assign taxes on Products

- Assign taxes on Shipments

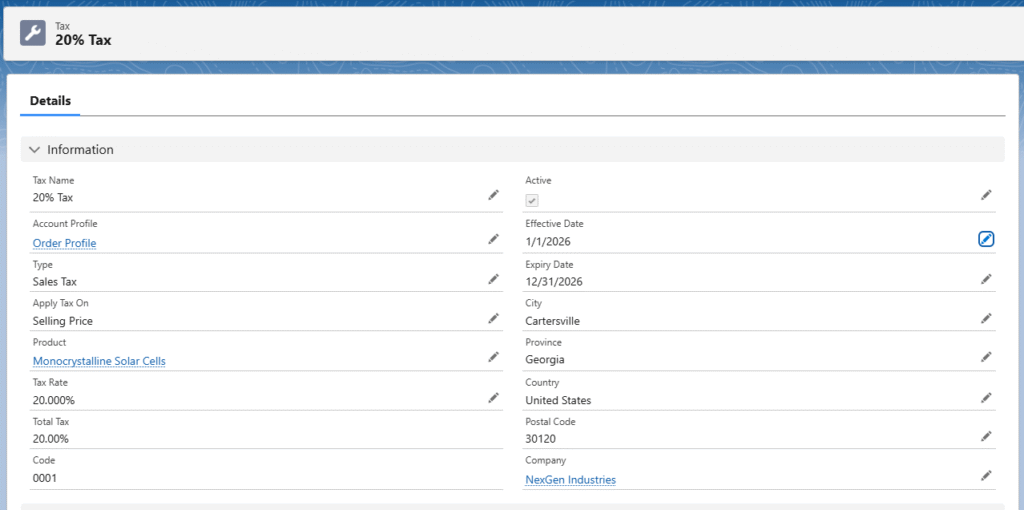

Create a Tax Record

- Navigate to the Profiling tab using the App Launcher or find the tab in the App Navigation menu.

- Select the Profile you want to associate the tax with. From the selected profile, go to the Related List and choose Tax.

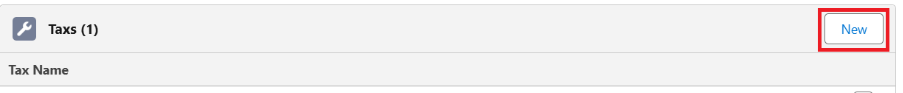

- In the Tax related list, click New to create a new tax record.

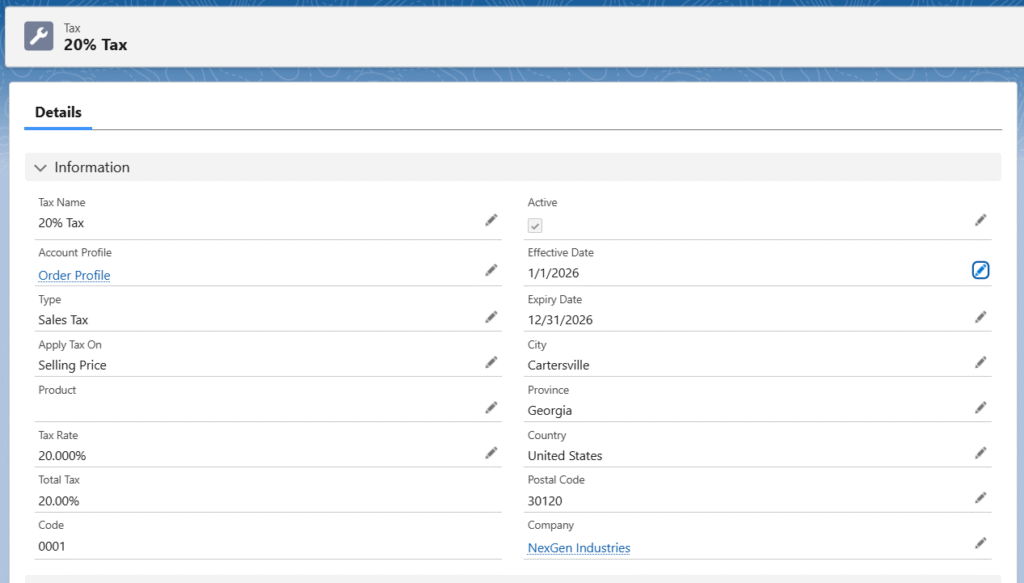

- Enter the Tax Name and select the Effective Date and Expiry Date.

- Select the Type of the Tax, whether it is a Sales, Service, or Shipping tax.

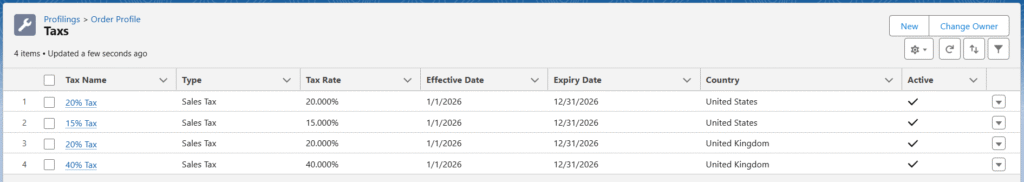

- Select the Country and Province; if both Country and Province are selected, then the tax will be applied for that province only.

- If Province is not selected, then the tax is applied for the Country.

- If Province and Country both are not selected, then the tax will be considered general and will be applicable to all orders.

- Enter the Tax Rate in percentage.

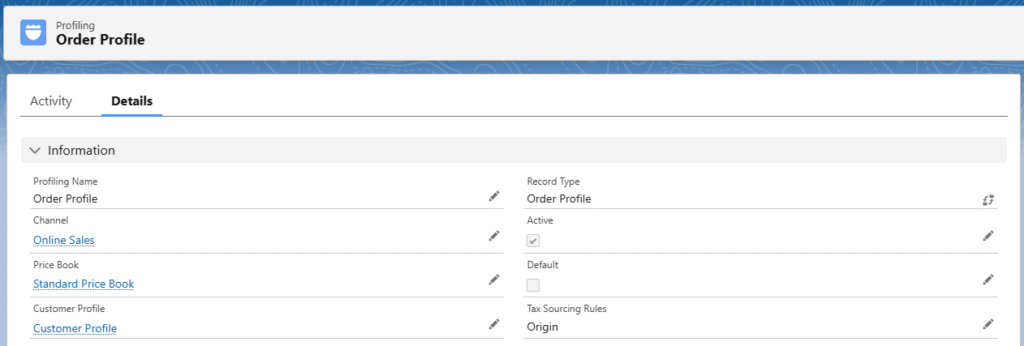

- Select the Account Profile to which the taxes are applied.

- Apply Tax On field lets you apply taxes on the selling price of the product or the cost price.

- Check the Active checkbox to make the record active.

- To apply the tax on a specific product, select the Product from the lookup; if not, keep it blank. This tax record will be considered to apply taxes on Sales Order.

- Click the Save button to create the tax record.

- When a Sales Order is created for a customer with tax in their Order Profile, the system auto-applies the Tax if the Address matches.

Assign the Taxes on the Sales Order

- Every Sales Order is generated for a customer, and the customer is associated with an Order Profile.

- In the related list of the Order Profile, the tax record will be available if created as mentioned in the above steps.

Assign the Taxes on Products

When a tax record of type Sales or Service Tax is created with the product in it, the system applies the tax to the Order Product that contains the same product.

Assign the Taxes on Shipment

- When a tax record of type Shipping is created, the system applies the tax to the Sales Order Shipping Amount field.

- The Shipping Tax will be calculated based on the Tax Sourcing Rule on the Customer Profile, which can be Origin or Destination.

Fields to Note:

| Field | Description |

| Tax Code | Describes the Tax record Name. |

| Country | Tax codes are unique for every country. This describes the country for which a Tax record is created. |

| Province | Every province differs in the tax rate. This field describes the province for which the Tax record is created. |

| Type | Describes the type of Tax, whether it is a Sales, Service or Shipment Tax. |

| Effective Date | Describes the date from when the Tax record is effective for use. |

| Expiry Date | Describes the date from when the Tax record can no longer be used. |

| Tax Rate | Describes the percentage of tax applied. |

| Product | Describes the product associated with the Tax record. This field is mainly used when product-specific taxes are created. |

| Apply Tax On | Describes whether the tax is applied to ‘Selling’ or ‘Cost’ price of the product |

| Account Profile | Different Taxes can be applied for different Account Profiles. Order Profile should always be selected while creating a Tax record |